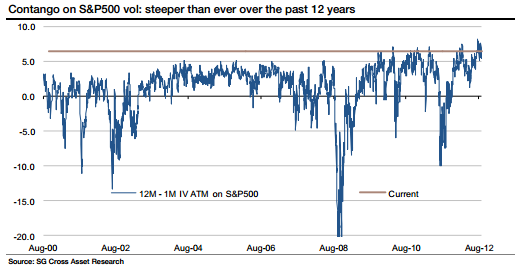

One thing we keep seeing all over the place is how the VIX (volatility index) is so low and that this means the market is extremely complacent and therefore on the verge of a decline. This might be true, but I think it’s important to provide some perspective when using an indicator like the VIX. To get a better idea of the VIX it can be helpful to look at more than merely the front month contract. In a recent research note analysts at Societe Generale elaborated on the current environment and the story behind the current VIX levels:

“the most striking aspect of the current situation is the historical steepness of the vol contango, meaning that mid/long-term volatilities are much more expensive (in vol point and historically) than short-term vols. If we try to translate this into a market sentiment analysis, we can say that the market is pretty confident in the short-term outlook but extremely cautious on the longer-term outlook.”

Without getting bogged down in the details, that basically means traders are complacent in the near-term, but extremely cautious in the long-term. So you kind of have a mixed reading here from a sentiment perspective. The VIX is useful in gauging perspective, but this is a good example of the mixed messages it can send at time.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.