I keep getting this question over and over again so I think it’s time I address it more directly. First, let’s begin by understanding what I mean when I say “money”. When I refer to “money” I am referring to the most widely accepted media of exchange – primarily currency (cash, coin and bank reserves) and bank deposits. It’s true that almost anything in the world can serve as “money”, but as it pertains to our every day lives it is bank deposits and currency that function primarily as money for purposes of transaction.

- See, What is Money?

I won’t get into what gives this “money” value, but I do think it’s important to distinctly differentiate the primary types of money that exist in our monetary system. “Inside money” is the dominant form of money. It is created “inside” the private sector in the form of bank deposits through loan issuance. “Outside money” is a facilitating form of money. It is created “outside” the private sector and exists in the form of cash, coins and bank reserves.

Inside money is created inside the private sector through the issuance of loans. And banks create these loans without having to multiply their reserves or check with the government first. Contrary to popular opinion, the money multiplier is a myth. The way banks create money is quite simple. When creditworthy customers walk in their doors they issue loans which create deposits and find bank reserves (if required) later. Banks are not constrained by their reserve balances as many neoclassical economists believe. In this form, banks rule the monetary roost by controlling the most widely distributed form of money in our monetary system. In essence, the government has privatized the money supply in what is really a market based system controlled by an oligopoly of banks who compete for loans.

Outside money is created outside the private sector. This includes cash, coins and bank reserves. Cash and coin distribution is maintained by the Federal Reserve who acts as an intermediary for the US government. The actual cash and coins are created by the US Bureau of Engraving and the US Mint, branches of the US Treasury. Bank reserves are deposits held on reserve at the Federal Reserve banks. All member banks in the Fed system are required to maintain a percentage of deposits on hold at the Fed. This system allows the banks to settle interbank payments in a way that is overseen and organized by a third party (the Fed). You can think of this as an exclusive banking system where only banks can transact. You and I cannot use bank reserves. This is the “money” that banks deal in when settling transactions among one another. Think of it like a nationalized banking system (as if there is one bank) without actually having to nationalize the banks (in other words, the interbank system brings settlement between different banks into one place, but maintains the market based competitive system in the private banking system).

So what happens when the Fed uses “outside money” to purchase bonds? Like any bank, the Fed can create money “from thin air”. This is how it creates reserve balances to transact monetary policy. It has always done this. For instance, in 2006 reserve balances increased by $50B at member banks as the Fed implemented policy, but no one complained about “money printing” and “debt monetization” back then. In other words, this is ALWAYS how the Fed implements policy. But QE has caused a great deal of confusion, thanks in large part to the neoclassical confusion regarding the definition of the “money supply”.

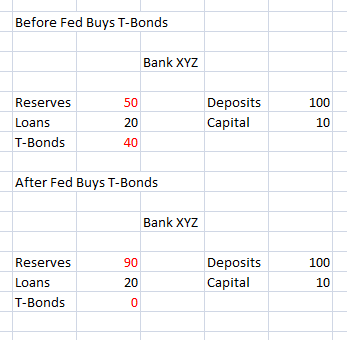

When the Fed purchases bonds they are simply changing the composition of the bank balance sheets. Lets look at a simple breakdown here showing the bank balance sheet before and after QE:

It’s important to note that the net financial assets of the bank are exactly the same after QE as they were before. In other words, the bank has experienced no change in its balance sheet except the composition. We know that banks don’t lend their reserves so this policy is unlikely to have a material impact on the primary form of money – inside money. There is much debate about some of the more nuanced points here (like QE’s impact on interest rates and bank recapitalization), but I don’t have the time or the space to get into those details here. The message I am trying to convey clearly is that the transmission mechanism via QE to increase the money supply is much weaker than most presume because QE is a simple asset swap that changes the composition of the private sector’s balance sheet (more cash and fewer bonds), but does not change the quantity of net financial assets in the private sector.

If we want to get very technical we would have to add that outside money in the system has increased. Ie, since bank reserves increase the money supply that neoclassicals focus on (such as M1) has been altered substantially. Assuming non-banks have been divested of a deposit, the supply of inside money has increased, however, the amount of net financial assets remains unchanged. Hence, the reason why monetary policy appears to be so broken. If they use that deposit to pay down debt then money has been destroyed. In an environment where demand for credit is weak, the Fed’s policies simply cannot effectively and directly increase the money supply that matters to the everyday economy.

* See here for more on the actual workings of our monetary system.

** QE can also be performed with the non-bank public. This transaction does increase the quantity of inside money, but also reduces the quantity of privately held bonds outstanding. Therefore, it doesn’t change the quantity of net financial assets held by the private sector. In short, you can think of QE as being similar to swapping a savings account (T-Bond) for a checking account (reserve deposits). There is no logical reason for this policy to be inflationary in its most general sense since the private sector has the same quantity of net financial asset before and after QE. In fact, one could argue that QE is marginally deflationary since it reduces private sector income via the lost income from the T-Bonds. I explain this in more detail here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.