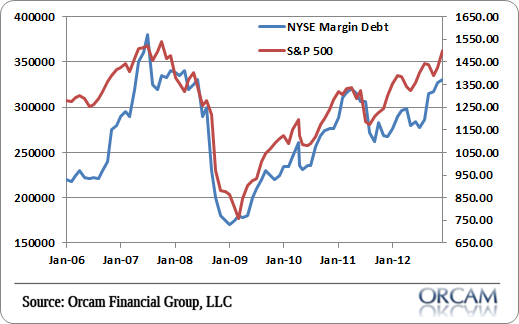

Here’s an interesting bit of correlation (and causation?) for you. Have a look at the chart I formulated below showing NYSE Margin Debt and the S&P 500. The two data sets show a correlation over 85%.

Now, this is really interesting in that it melds with our work on Monetary Realism and monetary theory quite nicely. Using Werner’s concept of disaggregation of credit we can clearly formulate how credit is being used at various times to benefit from improvement in the stock market. If you’re not familiar with the concept of disaggregation of credit please see here. But, in short, it is based on the understanding that our monetary system is almost entirely built around credit and how banks issue credit to perform various functions. These functions can be both good and bad.

The concept of disaggregation of credit shows how there can be productive and unproductive uses for this credit. Some forms of credit are purely good. For instance, a business that takes out a loan to pay employees, expand operation, perform R&D is a form of productive credit. An unproductive from of credit might be a trader who borrows on margin to leverage a position in a secondary market purely for market gains.

It’s interesting to note the tight correlation between margin debt and stock prices in our world that is so overly obsessed with nominal wealth. And we even encourage the use of leverage in the chase for this nominal wealth. Is that stabilizing? Or is it more destabilizing than anything else? I would argue that this obsession puts the cart before the horse, but that’s just me….

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.