Interesting commentary here via Business Insider and Jeffrey Kleintop of LPL Financial with regards to the recent surge in gasoline prices and how that might influence the economy going forward:

Danger Zone

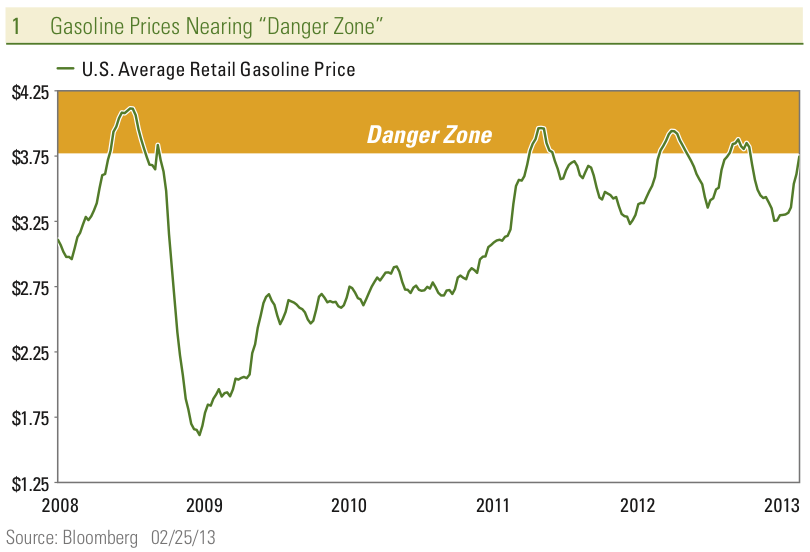

Watching the Daytona 500 from the “danger zone,” where cars whip by at high speeds of around 175 to 200mph—but can also burst through the walls in a crash — can be a thrill. But gasoline’s “danger zone” may be just plain scary. At $3.75, retail gasoline prices are nearly back in the “danger zone” marked by the highs of around $3.85 to $4.10 per gallon seen over the past five years, as you can see in Figure 1. This range has marked a “danger zone” for market participants. When gasoline prices reached this range in the past, it preceded the stock market slides experienced in 2008, 2011, and 2012.

While high gasoline prices were certainly not the driving factor in the 2008 U.S. financial crisis-driven plunge in the stock market, the high prices did add to stress on the economy as they did again in the springs of 2011 and 2012, when concerns over a European financial crisis rattled investors. Again in the fall of 2012, high energy prices weighed on investor sentiment and helped to fuel a pullback driven by the election and fiscal cliff concerns.

In short, high energy prices can make the economy and markets more vulnerable to a negative event that drives stocks lower.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.