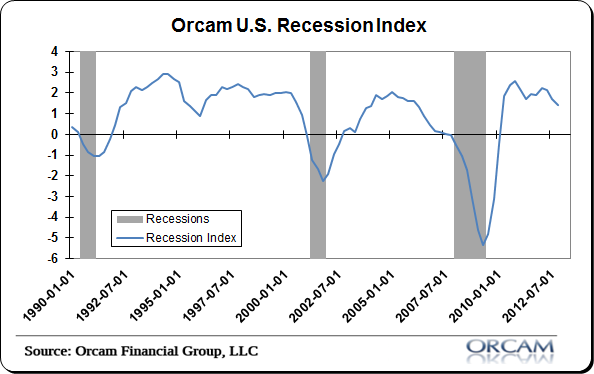

One of the main indicators I rely on for the cyclical view of the markets is the Orcam Recession Index (which I update in the research regularly). It’s helped me keep from bring bullish into each of the last two recessions (though a bit early in the last one) and has kept me from being too bearish in the last few years despite working under the understanding of economic weakness due to the Balance Sheet Recession.

What’s it saying right now? Well, not much has changed since I started loudly saying that the ECRI and others were wrong about their 2011/12 recession calls. It’s still trending lower, but historically, the index hasn’t turned negative until about 6-12 months before a recession hits. The current reading of 1.5 is pretty healthy considering the average reading over the 30 year lifetime of the data is about 0.85.

Of course, it’s easy to say you’re bullish after the market has surged, but I think the markets are mostly getting the longer-term trend right. That doesn’t mean I wouldn’t be careful in the near-term (I’ve in fact been cautious), but the tide moves all boats regardless of how fast you paddle and the tide is not pointing to a recession as far as I can tell.

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.