That’s what Schaeffers Investment Research is asking after a huge run in the market in recent months. Despite persistent chatter that everyone is expecting a market decline (eventually), the data shows that there aren’t many bears at all. Here’s Ryan Detrick from Schaeffers:

“It is expiration Friday and we are usually pretty busy, so here’s a quick chart that should give the bulls pause.

With news highs being made just about everyday, one thing to be aware of is investors are getting excited. Is this reason to sell everything? No. But don’t get trapped and go all in here either. Heck, Mila Kunis just said she is investing in stocks for the first time in years. This after being in cash during a huge bull market.

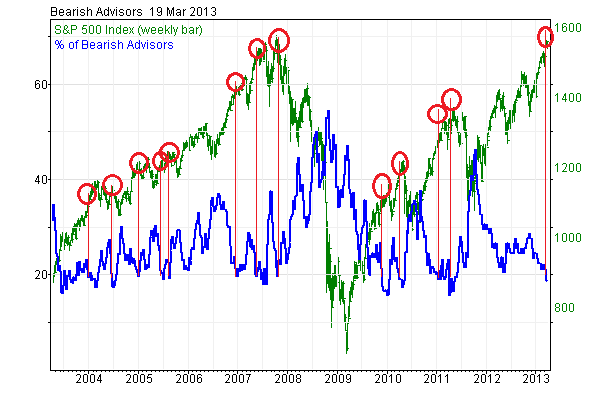

Here’s a chart of the % of bears from the Investors Intelligence survey. What you need to know is moves beneath 20% have been very worrisome going back the past few years. This after stubbornly not breaking this area the past month. Could this be the final capitulation?”

I did a little sleuthing and he’s right. There does appear to be some compelling evidence that readings below 20% tend to correlate fairly closely to market peaks. In fact, many of the worst declines in recent history occurred with very low bullish readings. Of course, this is just one data point in a sea of thousands, but it’s worth noting just in case the “wealth effect” decides to turn into a “poverty effect” at some point….

(Figure 1 – Investor’s Intelligence % Bears)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.