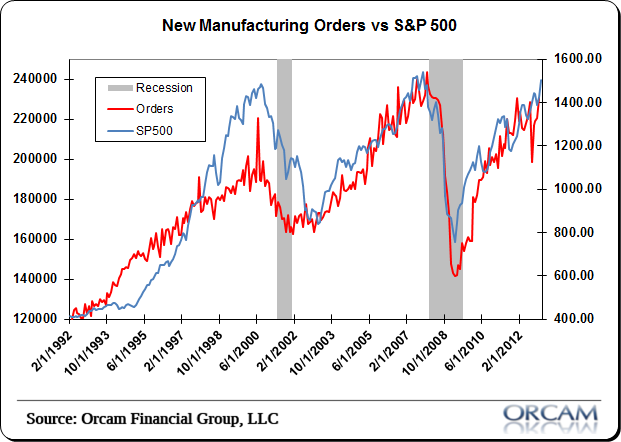

This morning’s durable goods figures were solid again though benefitting to a large degree from new orders at Boeing. Over all, the figures look decent though. The latest reading was the highest since 2007 and just shy of expectations ex-transportation. As the chart below shows, I like to track durable goods because they tend to track the S&P 500 very tightly. At present, I can’t say that there looks be to any sort of large discrepancies between the DG data and the markets….

Econoday has a bit more on the release.

“Aircraft led durables orders to soar in February-but the core disappointed with a modest decline. New factory orders for durables jumped a monthly 5.7 percent, following a 3.8 percent decrease in January. Market expectations were for a 3.5 percent increase. The transportation component rebounded a sharp 21.7 percent in February after dropping 17.8 percent the prior month. Excluding transportation, durables orders slipped 0.5 percent in February after a 2.9 percent gain the month before. Analysts projected a 0.7 percent rise in orders excluding transportation.

Outside of transportation, industry strength was seen in electrical equipment, up 2.9 percent; primary metals, up 1.7 percent; and computers & electronics, up 1.3 percent. Declines were led by communications equipment, down 7.6 percent, and fabricated metals, down 4.4 percent.

Nondefense capital goods orders excluding aircraft fell back 2.7 percent after rebounding a sizeable 6.7 percent in January. However, shipments for this series gained 1.9 percent in February, following a dip of 0.7 percent the prior month.

Today’s headline number benefitted from a rebound in Boeing orders. Although the core number fell short of expectations, it eased after a strong January. Manufacturing still appears to be on an uptrend.”

Chart via Orcam Financial Group:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.