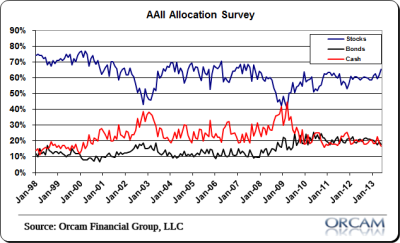

We’re finally starting to see the small investor chase equity returns. And they’re just in time for it all after a 150% rally. According to the most recent AAII investor allocation survey individual investors allocated their portfolios towards the highest equity weighting since September 2007. Meanwhile, bond allocations are close to the post-crisis lows and well off the 2009 highs when fear peaked

Here’s more via AAII:

“Equity allocations nearly hit an six-year high last month, according to the May AAII Asset Allocation survey. Cash allocations, meanwhile, fell to a level not seen since 2010.

Stock and stock fund allocations rose 3.5 percentage points to 65.2%. This was the largest allocation to equities since September 2007. It was also the fourth time in five months that stock and stock fund allocations were above their historical average of 60%.

Bond and bond fund allocations declined 1.6 percentage points to 18.1%. This was just the second time in the past 13 months with a fixed-income allocation below 19%. Even with the decline, bond and bond fund allocations were above their historical average of 16% for the 47th consecutive month.

Cash allocations fell 1.8 percentage points to 16.7%. Since hitting an 18-month high of 22.8% in March, cash allocations have declined by a cumulative 6.1 percentage points. May’s allocation was the smallest since November 2010. May was the 18th consecutive month with a cash allocation below its historical average of 24%.”

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.