Lots of data today. Let’s take a quick look at some of the releases.

- Pending home sales hit their highest level since 2006 as the real estate market continues to rebound. Record price increases haven’t been hampered by the recent surge in interest rates, which just made their highest 1 week jump in 26 years. The 30 year fixed is now at 4.46%, up from 3.4% just a few months ago. My guess is the combination of rising inventory, rising rates, weaker seasonal period and more difficult year over year comps will dampen the housing market a bit going forward.

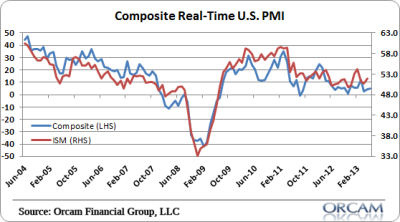

- The Kansas City Fed reported a weak manufacturing report at -5. This was down from +2 in May, but consistent with the weak readings we’ve seen in other manufacturing regions in May and June. Overall, this brings the real-time composite down to 4.9, which is still positive and consistent with a sluggish, but expanding economy.

Chart via Orcam Investment Research:

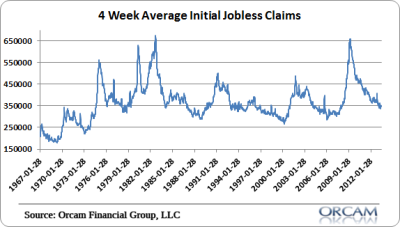

- Jobless claims continue to trend sideways at very low levels. This has been one of the better cyclical economic indicators over the years and currently points to a jobs market that is weak, but still expanding. Historically, we see readings closer to 300,000 when the economy is showing signs of robust growth and potential topping. We’re still well off those levels.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.