Here’s a good case of hedging your bets. So let’s say you really think hyperinflation is coming to Japan. How would you position for that? Maybe you’d short JGBs or short the Yen. But would you think to buy the Nikkei? Probably not. And that’s what Societe Generale analysts say might be the play in case of a Japanese hyperinflation:

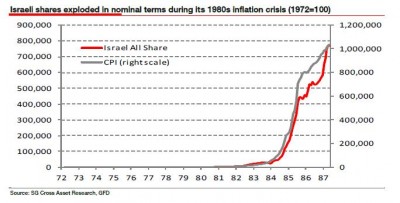

“In real terms equity prices fell (chart above), failing to keep pace with the rise in the CPI. But in nominal terms they exploded rising by a factor of around 6,500 over the period, in keeping with experiences of nominal share indices in Argentina, Brazil or Weimar Germany during their inflationary crises. A couple of clients have told me they think the trigger for a forced BoJ monetization of the government’s balance sheet can only occur when Japan starts running current account deficits, pointing out that sovereign defaults have only occurred in current account deficit economies. So long as Japan maintains its current account surplus it will be safe. But I’m still not convinced why this must necessarily be the case just because it has been in the past. Current account deficits would be critical for government funding if the swing government bond investors were from overseas, which they nearly always are. But in Japan today they’re not. The households effectively are. Why should the current account deficit even be relevant to what is effectively an internal issue?

Reinhart and Rogoff say that one of the tell-tale early signs that governments are struggling to maintain market confidence is when debt maturities decline. This is what is happening in Japan today. And the BoJ announced last week (to loud acclaim) that it was going to adopt a more Anglo-Saxon style of quantitative easing. The process is arguably underway. My concern is that once the door to QE has been passed through, it slams shut behind. The truth is we can’t know when this will happen. We suspect only that the writing is on the wall, and the further out we look, the bigger and bolder that writing becomes. But if Japan was to follow a similar trajectory to Israel’s, the Nikkei would trade at around 63,000,000 (63 million) by 2025.”

Now, I don’t buy the Japan hyperinflation story, but I guess if I was a hyperinflationist this is the way I’d hedge my bets. If the Japanese economy booms then equities go up and you were right. And if the dooms day hyperinflation story occurs then you can say you were right either way. Of course, equities don’t go up in real terms during hyperinflation, but no one will care once your hyperbolic prediction is right.

Now, I don’t buy the Japan hyperinflation story, but I guess if I was a hyperinflationist this is the way I’d hedge my bets. If the Japanese economy booms then equities go up and you were right. And if the dooms day hyperinflation story occurs then you can say you were right either way. Of course, equities don’t go up in real terms during hyperinflation, but no one will care once your hyperbolic prediction is right.

Then again, if you’re like me and you see a declining population, structural headwinds and a Bank of Japan that appears to be trying to turn the Nikkei into a casino, then you might be a bit more prudent and say “no thanks, I’ll play in another sandbox.” But that’s just me.

Source: SocGen

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.