“It’s pretty depressing for those who would like to believe that analysis and evidence matter. The recent evolution of both policy and conventional wisdom on macroeconomics seems to suggest otherwise.” – Paul Krugman, 8/4/13

I keep seeing some of the inflation doves (low inflationists) tooting their own horns over low inflation predictions during the crisis years. But there’s a big problem with the predictions some of these inflation doves made and they don’t seem to fully understand it. Now, I hate to snipe at Paul Krugman, but hey, when you’re the top dog in the economics kennel, the rest of us puppies are bound to bite at your ankles on occasion (my apologies for the bite marks in advance). So here goes….

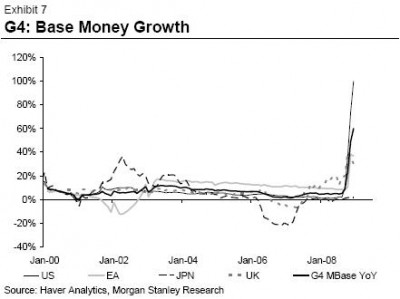

Back in 2009 & 2010 we heard all sorts of scary predictions about hyperinflation or high inflation. Most of these predictions were based on a basic misunderstanding that was a fairly mainstream belief before the crisis – the myth of the money multiplier. So, you saw all sorts of charts (like the following one from Morgan Stanley) which showed the monetary base exploding:

There were three basic interpretations of this chart – 1) the Austrians, hyperinflationists and some prominent mainstream supply side economists said this would cause high inflation; 2) the liquidity trap theorists said it wouldn’t cause high inflation YET because the banks wouldn’t be incentivized to lend out their reserves YET; 3) people like me have repeatedly said that the higher monetary base would not lead to more lending, not because of a liquidity trap, but because banks NEVER lend their reserves (even outside of a supposed “liquidity trap”) and that inflation would remain low because the economy would remain far too weak to create high inflation (because demand for credit was weak and banks were tight).

Obviously, the hyperinflationists were wrong. And the liquidity trap theorists think they had it all right. Yes, their inflation prediction was right, but not for the right reasons. For instance, in 2009 Paul Krugman responded to the base money predictions saying:

“the problem was that since banks weren’t lending out their reserves and people were keeping cash in mattresses, the Fed couldn’t expand M2.”

The thinking there basically said that banks would normally lend out their reserves, but they wouldn’t do so in this particular environment because of the liquidity trap. But banks NEVER “lend out their reserves”. Reserves are deposits issued within the interbank system and they stay within the interbank system. They’re used for two primary purpose: 1) to meet reserve requirements; 2) to settle payments. When a bank wants to make a new loan it doesn’t check its reserve balances first. It checks the creditworthiness of the borrower and measures the risk of the loan. If it needs reserves it will find them in the interbank market or borrow from the Fed AFTER the fact. A bank is always capital constrained, but never reserve constrained. There’s no “multiplying” of reserves in this process.

More and more people are coming around to understanding all of this now (including some Fed employees), yet we still see the liquidity trap theorists claiming to have predicted the low inflation environment for all the right reasons. The reality is that they were right despite the same misunderstandings many of their mainstream colleagues based their high inflation predictions on. They didn’t have a better model or even a better interpretation of that model. It was the same wrong model with a different bet – the one that just so happened to be right.

The point of this post is important – you didn’t need liquidity trap theories and loanable funds based IS/LM models to understand why the high inflation never came. All you needed to understand was the very basics of banking and some broader macro understanding of the debt crisis the US consumer confronted after the housing bubble burst. Paul Krugman is making an example out of the hyperinflationists to try to show how their model and understanding of the world was deficient and his model and understanding was superior. But his model isn’t superior. It’s the same flawed model that most of mainstream econ uses (the one based on a loanable funds view that doesn’t exist in the real-world of banking). Granted, he called the crisis FAR better than the Austrians did and he deserves praise for that, but that doesn’t mean the model was all that much better. It just means it was less bad. That’s about all.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.