Pretty interesting data here from Charles Gave (via John Mauldin):

“I started in the fascinating business of trying to understand why markets go up and down in February 1971. The old money manager in the French bank which had hired me straightaway said: “Charles, you will never get rich in this business using other people’s money. Do NOT leverage your positions. Leverage might be all right for fellows who deal in real estate, but for those in stock markets, it only brings misery.”

Being young and smart (or so I thought), I assumed this advice could not conceivably apply to me. A few margin calls later, accompanied by quite a string of sleepless nights, and I came to realize that the old gentleman had a point.

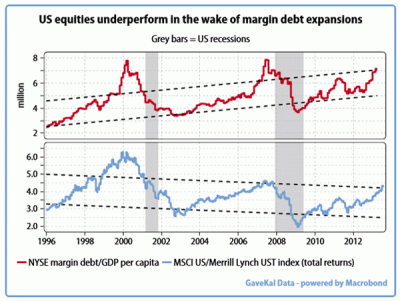

Now that I am quite old myself and certainly not as smart as I thought I was in 1971, I find myself tracking the moves of the poor souls who believe they can leverage profitably. Then I do the opposite. This is why Charles the 70-year-old is watching what Charles the 30-year-old is doing—to do the reverse. Have a look at the graph.

The red line at the top is New York Stock Exchange margin debt as a multiple of US GDP per capita, the black line on the bottom pane is a ratio between US stocks and (government) bonds. It seems that the fellows using other people’s money to get rich have an uncanny ability to leverage up when shares become overvalued vs. bonds. They also seem to get most enthusiastic just before a recession, usually after a prolonged outperformance of equities against bonds.

They leverage in order to participate as much as possible in what looks like a free ride, with no downside risk. There are always a number of good reasons why the stock market cannot change direction. Take your pick: “technology has created a new type of economy,” or “house prices never go down,” or “we have recently discovered an infinite source of wealth called QE.” These reasons can be added to a long roster of other excuses such as, “I can get insurance against the next market decline” (1987) or “the Fed will never, ever allow for positive real rates to appear” (1979) or “oil prices cannot quadruple” (1974).”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.