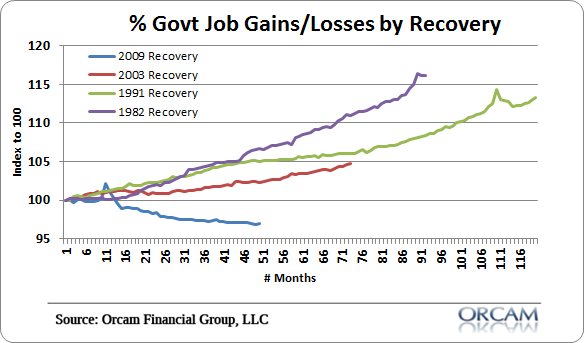

One of the more interesting things during the recent recovery is that it has occurred almost entirely without aid from government employment. The USA lost 8.6 million jobs during the financial crisis (from peak to trough) and has recovered about 6.7 million of those jobs. The private sector has recovered 7.4 million of those jobs all on its own. But what’s interesting is that the government has actually shed 700,000 jobs since the 2008 peak.

Now, the reason this is unusual is because this almost never happens during a recovery. For instance, if we look at recoveries in the last 30 years you see a distinct trend in government employment. One of the largest automatic stabilizers in the economy is the government workforce. When private jobs decline and recession occurs the government tends to just plug along. But not this time around. The government has been a big detractor from employment growth during this recovery.

Of course, the government has also run consistent trillion dollar deficits during this recovery so it’s not like this has been austerity, but for all the people discussing how bad the job market is, well, here’s one of your primary reasons relative to past recoveries. If the government had done what it normally does and employed more people during the recovery then the unemployment rate would be a lot lower, we’d be above our all-time highs in non-farm payrolls and there’d be a lot less talk about Food Stamps and how miserable the recovery has been.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.