We got a couple of local manufacturing readings this morning from the Dallas and Chicago areas giving us a better overall picture of the national manufacturing outlook for September. The Dallas Fed Survey showed some positive news as the general business activity index jumped to 12.8 in September from 5 in the previous month. The Chicago PMI showed a similar trend with the broad index rising to 55.7 in September from 53 in August. The new orders index jumped to 58.9 which was the strongest reading since February.

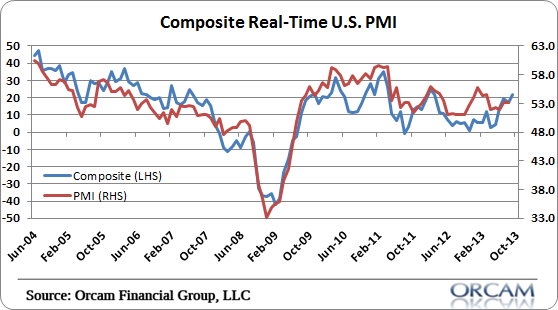

Overall, this brings the composite real-time index to 22 in September which is roughly in-line with the Flash PMI report we saw law week from Markit. A low 50’s reading in the PMI reports are likely to hold when the data is released next week. It’s weak growth, but it’s growth and some of the internal indicators are pointing to a slight pick-up.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.