Jesse Livermore, who you can follow on Twitter, wrote another tremendous post over at his site here. In this latest post, he constructs a very smart way of looking at potential future stock market returns through the preferences of asset allocations. And it turns out that the metric is pretty useful for predicting what the stock market might return. He constructs the model using a lot of sound macro thinking to arrive at a fairly simple equation:

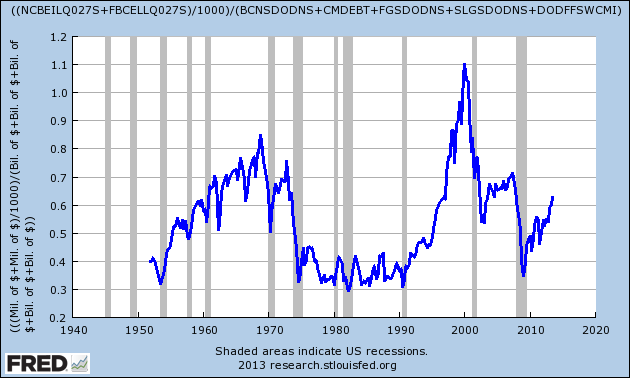

Investor Allocation to Stocks (Average) = Market Value of All Stocks / (Market Value of All Stocks + Total Liabilities of All Real Economic Borrowers)

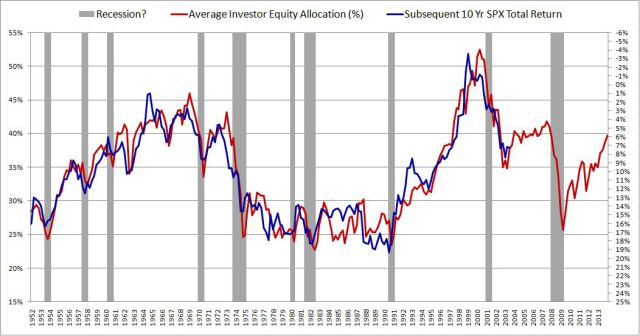

And if we sum all the different parts of the puzzle we arrive at this:

Which is derived from this:

There are a lot of moving parts here, and to be honest, I haven’t fully digested what Jesse’s put together here. But I like the structural thinking from a macro perspective. And I particularly like that he’s embedding a behavioral component here that reduces some of the flaws often seen in valuation metrics. Still, I am skeptical of the idea of constructing asset allocation models using such a metric and how applicable this is to an actual portfolio plan. But I really like how he’s thinking about this. It’s a very sound macro thought process.

I’d love your thoughts here if you have any. It’s a long read, but I highly recommend you have a look over the weekend at some point.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.