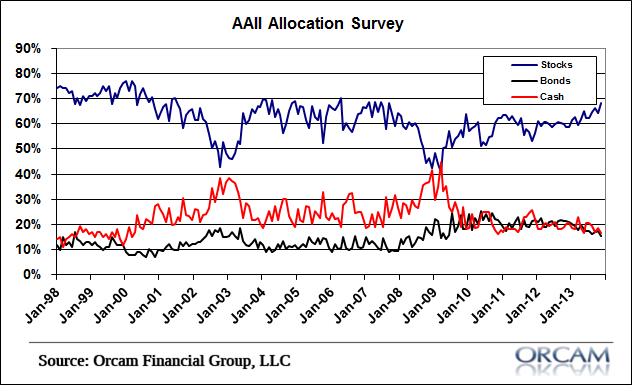

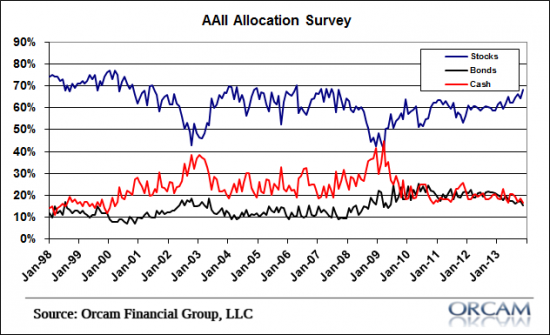

The latest asset allocation survey from AAII showed a new high in demand for stocks and new lows for both cash and bonds. Stocks experienced a notable jump to a 68% allocation from just 64% in November. Bond holdings were down 2% to just 15% and cash holdings were down 2% to 16.5%.

Historically, stocks have averaged a 60% allocation. The 68% level is not only high historically, but is also the highest level since July 2007 just before the S&P 500 peaked.

Source: AAII

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.