4 Things you should read:

- Why “Buy what you know” is flawed – BlackRock

- ‘60/40’: Version 2.0 – ETF.com

- Ignore the January Barometer – Barry Ritholtz

- Dealing with your schizophrenic investing tendencies – Forbes

1 Data and Market Summary:

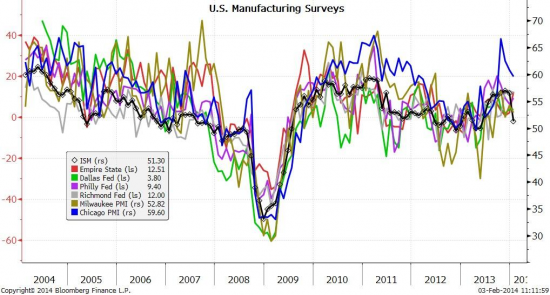

- Manufacturing readings were weak in the US. The ISM report came in at 51.3 vs expectations of 56. New orders were particularly weak with a historic drop of 13.2 to just 51.2. This is consistent with last week’s durable good’s orders. The PMI report from Markit was a bit better at 53.7. This was just shy of expectations of 53.9. New orders were down to 53.9 from 56.1. New export orders contracted at 48.4.

- Eurozone PMI hit 54, up from 52.7 in December. This is a 32 month high.

- China’s non-manufacturing came in at 53.4, an eleven month low.

- Fears of global weakness were sparked by the Chinese report which sent the Yen higher and renewed fears of a global slowdown and potentially larger problems in emerging markets. The US markets were down over 2% and are now off 5%+ year to date.

1 Pretty Picture:

- How weird was today’s ISM reading? Well, you can see how the national index has diverged from the regional indices (chart via Michael McDonough):

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.