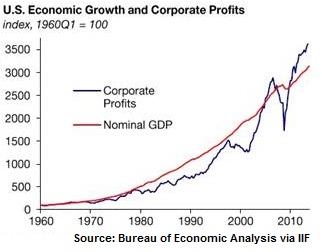

Just passing along a pretty interesting chart here from the WSJ on US economic growth and corporate profits:

“The U.S. has its own potential problem: corporate profits may be overshooting what growth.

Last year, cost-cutting, stock buybacks and rising corporate profits fueled U.S.-equity buying. Margin debt, when investors borrow from their brokers to finance stock purchases, hit record levels in 2013.

But the IIF says the growth in earnings per share could decelerate this year and, combined with a re-evaluation of stock values, equities are vulnerable to large price corrections. The historic levels of margin debt could accelerate the U.S. equity sell-off, especially as investors seek to shed the amount of risky assets in their portfolios in gloomier markets, the IIF said.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.