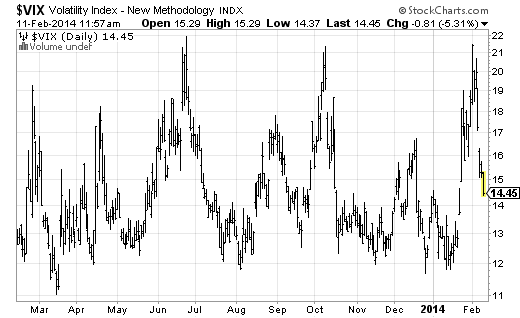

Volatility is back. Well, actually, the last year has been more volatile than you likely think. It’s just that the rate of change in volatility has been extremely short-lived when it’s been here. That is, the last 4 times the S&P 500 has declined the selling has been met with increasingly voracious buying. In other words, as Mister Market’s bi-polar disorder flips he actually seems to be learning from the events of the past. You can see this in the VIX in the last 12 months where sell-offs have led to high and increasingly brief periods of fear:

Of course, the assumption in this market response is that the future will always reflect the past. Which essentially means the market’s bi-polar disorder is combating a nasty case of recency bias. In other words, this guy looks like a big mental mess. This sort of action can keep behavioralists up thinking for days….As for the rest of us, it just results in a lot of lost sleep.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.