There’s been a lot of chatter in recent days about how the Fed “blew it” in 2008 and let the economy slip into a crisis (see here, here & here for instance). The common theme in this theory is that the Fed just needed to be more proactive. They needed to implement forward guidance, more QE or something else that would have helped avoid the crisis. But this view ignores the fundamental imbalance that was occurring inside the financial system and assumes that Fed policy could have propped up what was essentially a bankrupt banking system.

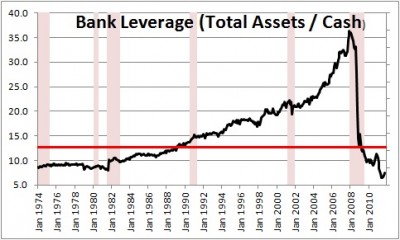

When we look back at the crisis we can see what was clearly a substantial imbalance in the financial system. For instance, this picture provides a general perspective of what was building up in the finance sector:

What could the Fed have done about that? Sorry, but forward guidance and rate cuts weren’t going to change the fundamental balance sheet problem here. Banks were leveraged to the hilt and all it took was a slide in home prices and mortgage defaults to cause a ripple effect.

Of course, they could have QE’d a whole bunch of the bad assets off the bank balance sheets (which, they ultimately did). But what are we advocating then? Are we basically advocating that a pseudo-government agency should just always get ahead of recessions by buying bad assets from banks when they look leveraged? That would be madness. It would simply promote a Ponzi effect in the banking system which could actually make things worse in the long-run.

Now, don’t get me wrong. I think the Fed could have done more. They could have been more proactive and they could have softened the blow in 2008. But could they have helped us avoid recession in 2008? I say no way. The leverage imbalance in the financial system was like a face in search of Mike Tyson’s fist. There was no getting around the fact that the leverage needed to come out of the system and it was going to happen whether the Fed wanted it to or not. Policymakers could have done more, but it’s naive to assume they could have thwarted recession entirely.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.