One of the more useful behavioral aspects espoused by Hyman Minsky was the concept that stability tends to create instability. In other words, in financial markets, we often see the most unstable markets building at times when they appear to be the most stable.

The thinking behind this is simple. When times are good people tend to get complacent, buy into groupthink and act less rational than they otherwise would. For instance, when a positive trend is in place in housing prices and everyone appears to be making money hand over fist flipping houses you might decide it’s a good idea to get in on the trend. And the banks see everyone making money so they decide to relax their lending standards a little bit thereby offering credit to lower credit borrowers. And then Wall Street jumps on the bandwagon and decides that they can securitize all of these new “low risk” mortgages and resell them. All of this complacency creates a growing instability in what looks like an illusion of stability.

What piqued my interest here was this great post at the WSJ’s Money Beat blog on IPOs:

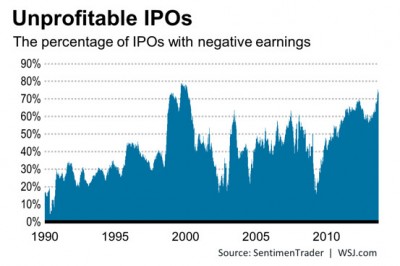

“Since 1990, 42% of companies that have gone public, on average, haven’t been profitable, Mr. Goepfert says. As the chart below shows, in the early-to-mid 1990s less than 1/3 of these companies didn’t generate profits. This percentage rose through the tech bubble, fell afterward and rose again through the 2007 market peak before tumbling to as low as 15% in October 2009, seven months after the bear-market bottom.

In the past several years the percentage of unprofitable companies going public has hovered predominantly between 55% and 65%. It moved back above 70% early last month.”

This looks stable for now. But something tells me we could look back at a chart like this in the coming decade and describe it as a period of growing instability.

This looks stable for now. But something tells me we could look back at a chart like this in the coming decade and describe it as a period of growing instability.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.