If you’re worried about high inflation then you must definitely think that the markets have things all wrong. As we all know, inflation, as measured by the CPI has been extremely low for the last 5 years. The latest reading of 1.1% is well below the historical average reading of about 3.5%.

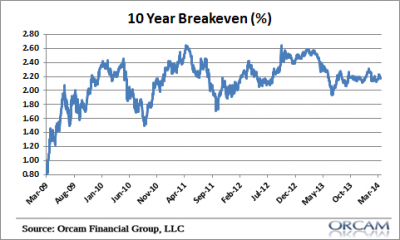

But the past is the past. One of the better ways to gauge the market’s expectations of inflation is to look at the 10 year break-even. This is just the yield on the 10 year versus the inflation protected equivalent. When this rate is moving higher it means that the market is pricing in higher inflation expectations and vice versa.

So, what’s it telling us today? Not much. In other words, if the markets are right then low inflation is here to stay.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.