Late last year I gave a talk at the University of South Carolina arguing that the economy would muddle through in 2014, recession wouldn’t strike just yet and that the stagnant economy would leave the Fed in a highly accommodative position. I don’t think much has changed since then.

When we look at the potential future of central bank policy I think it’s crucial to focus on inflation. Despite the dual mandate in the USA, Central Banks tend to be more concerned with inflation at the global level (I’d even argue that the Fed is more concerned with inflation than unemployment). And when we look at global inflation this remains one of the key signs of global stagnancy that leaves Central Banks feeling validated in their accommodative stances.

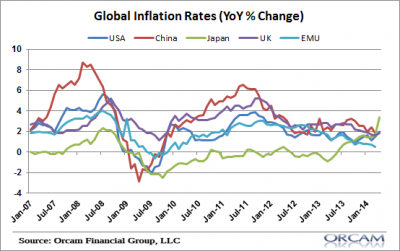

As you can see in the chart below low inflation around the globe persists and leaves many confused about the state of the global economy. The latest readings show a broad low inflation or disinflationary environment that is consistent with weak global growth prospects.

Inflation is below 2% in the USA, China, UK and Europe. And the latest readings in Japan have some concerned that the consumption tax and price of rising imports arising from recent policy changes could actually be a harbinger of weaker future economic data. But the biggest story, in my view, remains the weakness in the USA and Europe where the USA is crawling out of the de-leveraging cycle and Europe remains mired in an unworkable currency system that is beginning to make Europe look very Japanese.

On the whole, the risk still appears to be to the downside as the so-called “recoveries” in the developed world are now entering longevity that is consistent with higher recession risk and policies like QE and fiscal stimulus appear to have been insufficient in bringing economies back to full strength. So the policy outlook is likely to remain “highly accommodative” in my view, ZIRP is here to stay, QE is the central bank policy lever of the future and any real form of tightening is nothing to be concerned about in the immediate future.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.