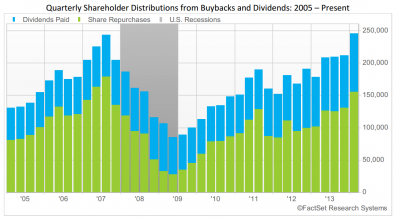

We’ve officially round tripped it now. Not only is the VIX at pre-crisis lows, but corporations are now issuing dividends and buying back shares like the crisis never happened (via Fact Set):

“Dividends per share (“DPS”) for the S&P 500 grew 12.5% in the trailing-twelve month (“TTM”) period ending in April. This also marks the thirteenth consecutive quarter in which DPS has grown at double-digit rates. Long-term, significant dividend growth—coupled with growth in share repurchases (which grew over 50%)—has helped quarterly shareholder distributions to reach record levels since at least 2005. In total, $249.1 billion was distributed to shareholders in Q1, which modestly surpasses the $242.1 billion distributed in Q3 2007.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.