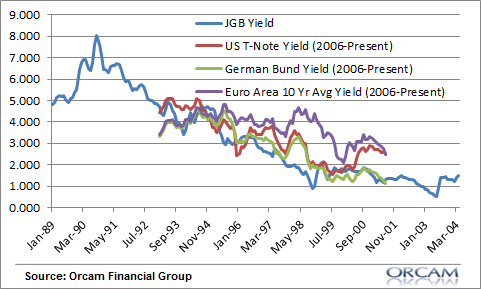

The WidowMaker trade became famous in Japan over the last 20 years as bond traders continually bet again Japanese Government Bonds in the face of falling yields. It’s a story that’s not unfamiliar in the USA where we’ve heard countless stories about how government bond yields are sure to rise at SOME POINT.

What’s interesting about Japan’s case is how they suffered through deflation for such a long period while the rest of the world was seemingly healthy. But now the entire world appears to be following the general trajectory of Japan in the 90’s. And we’re seeing outright deflation in parts of Europe.

Historical comparisons are always tricky. No two historical environments are ever the same and there’s different dynamics in Japan in the 1990’s than there would be in today’s Europe, for instance. But the result looks very similar. Japan suffered a credit driven deflation following asset bubbles whereas Europe appears to be suffering from a similar disinflation/deflation that is the result of the dysfunctional currency union which led to credit issues. Different causes, but similar results. The outcome, from the perspective of bond markets, looks messy and tragic…

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.