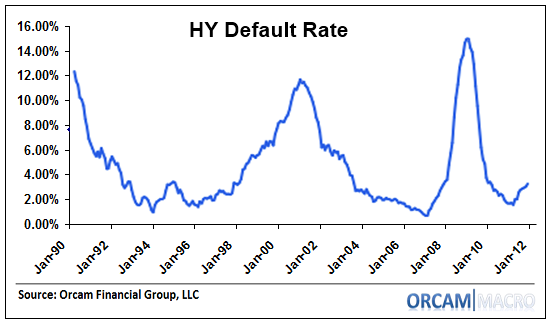

Here’s an interesting downgrade from Morgan Stanley that carries some macro relevance. They’ve downgraded their view on high yield credit due to some “cracks in the fundamentals”. They’re not sounding the alarms at this point, but they say HY credit is now priced richly. We saw similar commentary the other day in IG corporates. The creeping high yield default rate is usually consistent with deteriorating fundamental so MS’s downgrade is worthy of attention here. More from Morgan Stanely:

“Our credit downgrade is not purely a valuation call. For the first time in a few years we are seeing weakness in the macro data filter through to high yield fundamentals.

To be clear, the starting point matters, and balance sheets are still very healthy in aggregate. Nevertheless, some of the fundamental tailwinds that have supported high yield credit over the past few years seem to

be abating. For example, leverage is now ticking higher for the median high yield company for two separate reasons. 1) Many high quality companies are incentivized to issue debt given record low yields; and 2) About 34% of the HY market actually had negative YoY LTM EBITDA growth in 2Q12, because of the weak growth backdrop mentioned above.…

In addition, we are also seeing a pickup in idiosyncratic situations and weakness in certain economically sensitive sectors, due to slower global growth (the Metals/Mining HY sub-index is up 5.3% YTD, vs. 12.4% for the broader index). Lastly, defaults are creeping higher, up from the lows of 1.9% in Dec 2011 to 3.5% today. In general, we think default risk is still low over the next year or so given factors such as the health of corporate balance sheets, and backdated maturity schedules. But if economic growth does not pick up, defaults may continue to trend towards the longterm average of 4.8%, another modest headwind, especially

given current valuations.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.