I’ve shown on several occasions why recession forecasting matters (see here & here). Get a recession call right and you’re like to miss out on potentially huge market moves to the downside. Get a recession call wrong and you’re likely to sit out while the market churns higher (as we’ve seen over the last few years).

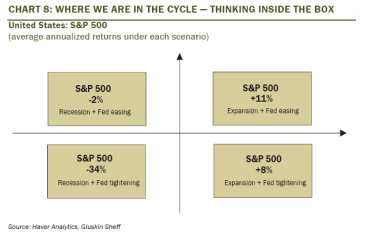

In a recent note, David Rosenberg provided an interesting bit of additional insight here. He shows the market performance when the Fed is tightening, easing, in recession and not in recession. Now all we need is a box for “Expansion + No one knows what QE is” and we’ll all know where the market’s headed.

More via David Rosenberg:

“At the same time, in the name of staying disciplined and caring about what history has to say on the matter, if the economic is not in a recession and the Fed is in accommodation mode, the overall tendency of the market is to push higher.

…

So if there is no recession and the Fed remains accommodative (its balance sheet expansion is akin to a 125 bps rate cut this year) history, for what it’s worth, tells us that bull markets are more the norm than bear markets (correction aside), and the ‘clock’ below shows these episodes to be the most constructive for equity market performance.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.