Any time I write a story about inflation I inevitably get lots of responses about asset price inflation. For some reason this is always implied as a bad thing. But asset price inflation is not necessarily bad. In fact, a little asset price inflation is a good thing.

If we look at this from a balance sheet perspective we should hope that our assets become more valuable over time because this increases our aggregate net worth. And when our net worth increases our balance sheets improve as this means our assets are worth more than our liabilities. This allows us to spend more, borrow more, invest more, etc. This is a net positive for the economy.

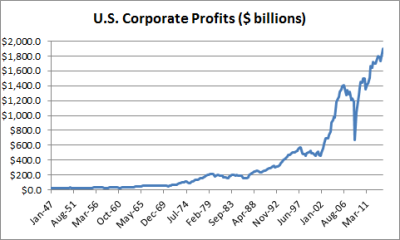

Of course, any rise in asset prices should reflect reality and not just some irrational exuberance. As I’ve repeatedly stated over the last 5 years there does appear to be a fairly rational explanation for the rise in asset prices beyond just the Federal Reserve. And that’s this beauty of a data point:

Of course, asset price inflation can be dangerous. We all know that following the housing bubble as well as the tech bubble. When asset prices rise in an irrational manner it often coincides with an unsustainable spending boom. That is, people think they’re much wealthier than they really are and the improvement in balance sheets can lead to a boom which inevitably leads to a bust. This is particularly dangerous when it leads to a leveraged boom as we saw during the real estate bubble. So yes, asset price inflation can be dangerous in extremes.

In moderation, a bit of asset price inflation is a good thing. It’s only when the boom becomes irrational that we begin to see balance sheets become unstable and unsustainable. This is a legitimate worry and I think we’ve learned this lesson since the financial crisis, but I am not so sure it’s actually something we can avoid. After all, if you believe like I do, that the financial markets and economy are made up of irrational participants then extremes are unavoidable at times. Whether we have a Central Bank to push us there or not the greed of market participants seems to inevitably get us there at times.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.