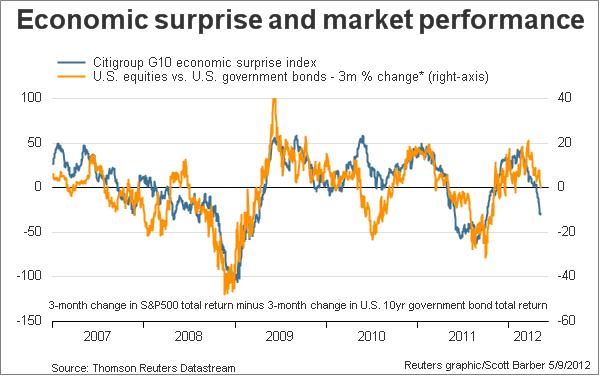

Citigroup’s Economic Surprise Index has been very highly correlated with equity vs bond returns over the last 5 years and recent trends point to a continued negative outlook for equities and bullishness for bonds. Now, I would never put too much emphasis on any single indicator, but this one does bring many different aspects of the market together. I particularly like these sorts of indices that compare expectations to reality. It provides a real-time idea of whether investors are potentially flat footed and expecting too much out of the market….

Scotty Barber at Reuters provides a nice chart:

“Citigroup’s G10 economic surprise index has taken a nosedive in the last couple of weeks”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.