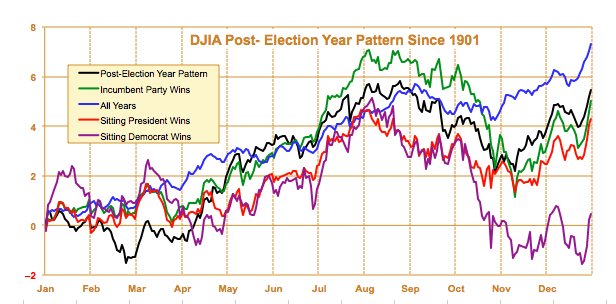

A lot of investors put enormous emphasis on seasonal trends and the Presidential cycle. I can’t say that I do, but it’s always an interesting study in historical market trends. According to Jeffrey Hirsch and the Stock Traders Almanac next year doesn’t bode well:

“We’ve got a sitting president that has won re-election, normally the post-election year is not great, you see a sell-off,” says Hirsch. “Sitting presidents winning has not been the greatest performance, it’s usually flat to down.”

Check out Hirsch’s chart below showing the Dow Jones Industrial Average’s performance in the year following an election.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.