Danske Bank, who has been very bullish in recent years, is joining the chorus of banks that is becoming increasingly concerned about a global slowdown. In a recent note they discussed their macro outlook and where they see the risks to the downside:

Summary and outlook

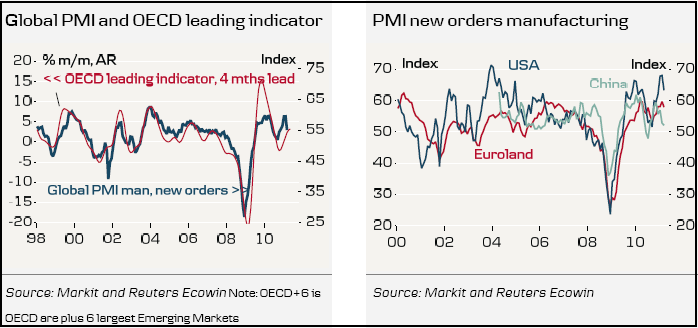

- Global leading indicators are showing signs of weakening, but they are still at comfortable levels. US ISM declined modestly from a very high level in March. Likewise, European PMIs still look good, but survey expectations point towards a slowdown in growth. In China the slowdown seems to have taken hold.

- We expect the majority of the leading indicators to decline to less expansive levels in the coming months, but to remain at decent levels. However, several factors could temporarily speed up the decline. Rising oil prices, caused by the Middle East turmoil, lead to rising production costs and reduced purchasing power. The disaster in Japan hampers Japanese production and could also disrupt global supply chains. Finally, the recent slowdown in China reduces demand growth from Asia.

Details

- Global PMI new orders have dropped to 55 from the peak last month at 60. This is the first drop since September 2010, confirming the expected slowdown in growth.

- In the US, ISM declined moderately from 61.4 to 61.2, but the new orders index took a dive indicating further corrections in the coming months. Hence we expect ISM to continue to decline.

- In Euroland PMIs generally sent a positive signal, with Germany being the driving force. However, here as well, we expect to see adjustments in the coming months. Scandi leading indicators are somewhat less positive, but generally point to decent growth rates, yet Denmark is still trailing the rest of the region.

- Asia has been sending less upbeat signals lately. Chinese manufacturing PMI dropped also in March, indicating slowing growth. Other Asian PMIs are starting to point in the same direction. CEE PMIs have started to show some signs of moderation as well, but we continue to believe in healthy growth rates over the coming months. Similarly in Brazil PMI has lost its recent momentum.

Source: Danske Bank

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.