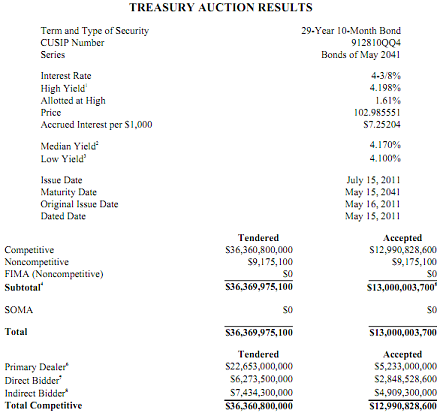

What has the world come to? How could today’s 30 year bond auction result in such strong demand? Of course, I don’t expect the investment community to rant and rave about the bond auction. They’re more likely to spend the next few hours coming up with excuses for the strong demand and nitpicking at the results for a possible weakness. But the facts are the facts. Even in the face of a potential default, the government of the United States of America is still able to auction off $13B worth of bonds with a bid to cover of 2.8. That’s nothing short of remarkable.

Now, if you understand how the process works, you recognize that spending comes before funding and that this is a simple reserve drain and nothing more. There’s nothing about this process that involves “funding”. The truth, unfortunately, is not nearly as sexy as a potential catastrophe though….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.