This morning’s CPI showed another very low reading at 0.9% on the headline and 1.7% at the core. It’s interesting to note that food and energy are now dragging down the index substantially. As I previously mentioned, food and gas are both down 7-10% so there’s your big headline drag. But the Fed and bond markets focus more on core CPI so we don’t want to overemphasize the headline reading anyhow. On the whole, this is all still very consistent with a weak economy.

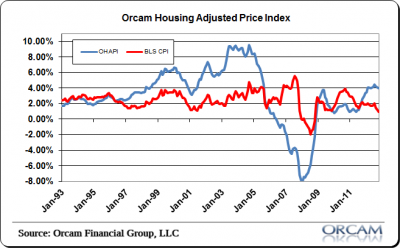

The Housing Adjusted CPI is up 4% due to the big surge in housing. I think this is probably overstating the current pace of consumer price inflation, but provides a bit of perspective on the frothiness of broader consumer trends since housing is a big piece of the consumer balance sheet puzzle. This index also shows the increasing volatility of the consumer balance sheet as a result of monetary policy that has been geared specifically towards bolstering the housing market to a large degree.

(Chart via Orcam Financial Group)

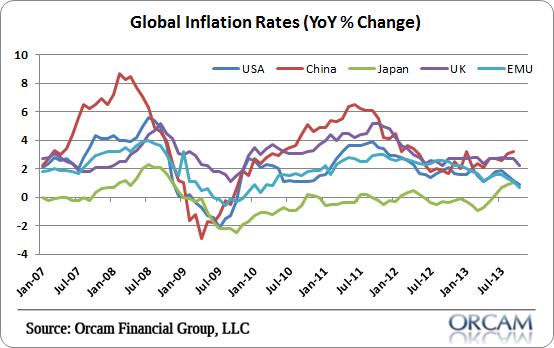

The more interesting data is not US centric, but from all around the globe. The trend in the USA is indeed a global trend as inflation rates are falling just about everywhere. The latest from the UK showed a decline from 2.7% to 2.2% and Europe down to 0.7% from 1.1%. China has seen a small uptick from 3.1% to 3.2% and Japan is still in the inflation doldrums at 1%. The low inflation is becoming a global phenomenon.

(Chart via Orcam Financial Group)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.