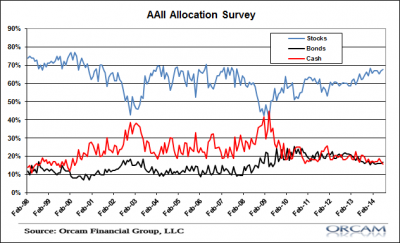

The AAII’s July asset allocation survey showed growing overall bullishness from retail investors as equity allocations jumped to their highest levels of 2014. The current reading of 67.5% is the second highest monthly reading since the bull market began in 2009. Here’s more detail from AAII:

“Allocations to stocks and stock funds reached their highest level of the year in July, according to the latest AAII Asset Allocation Survey. Bond and bond fund allocations rebounded to levels not seen since last January, while cash allocation fell to a 14-year low.

Stock and stock fund allocations rose 0.5 percentage points to 67.5%. This is the largest allocation to equities since December 2013 (68.3%). It is also the 16th consecutive month and the 18th out of the past 19 months with equity allocations above their historical average of 60%.

Bond and bond fund allocations rose 0.7 percentage points to 16.7%, the largest allocation since January 2014. The historical average is 16%.

Cash allocations declined 1.3 percentage points to 15.8%. The drop puts cash allocations at their lowest level since March 2000 (15%). July was the 32nd month with cash allocations below their historical average of 24%.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.