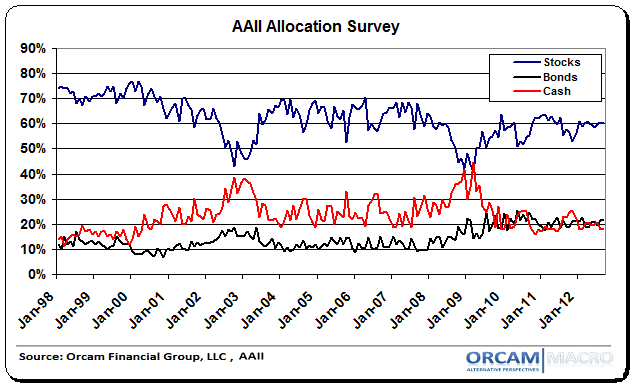

The latest monthly allocation reading from the AAII showed a continued jump in bond allocations as small investors continue to look for safe income. Although the continual Quantitative Easing policies have intended to push investors out on the risk curve they remain hesitant to stretch beyond fixed income. Here are the details from AAII:

“Fixed-income allocations rose to a seven-month high last month, as equity and cash allocations declined, according to the September AAII Asset Allocation Survey.

Stock and stock fund allocations declined 0.4 percentage points to 60.1%. The drop puts the September’s equity allocation near the historical average of 60%.

Bond and bond allocations rose 0.5 percentage points to 21.9%. This is the largest allocation to fixed income since February 2012. It is also the 39th consecutive month that fixed-income allocations are above their historical average of 16%.”

Source: AAII

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.