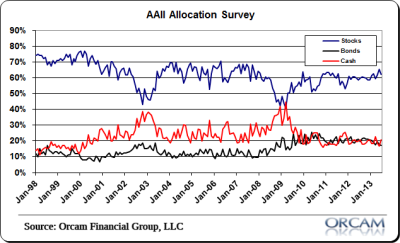

Small investors moved away from stocks in June and into cash according to the latest AAII allocation survey. Bond allocations also declined, though not as much as the stock allocations. Stock allocations remain above their historical average levels. Here’s more via AAII:

“Fixed-income allocations declined to nearly a four-year low as individual investors increased their cash allocations, according to the June AAII Asset Allocation Survey.

Stock and stock fund allocations fell 3.1 percentage points to 62.1%. Even with the pullback, this was the fifth time in six months that stock and stock fund allocations were above their historical average of 60%.

Bond and bond fund allocations declined 0.9 percentage points to 17.2%. This was the smallest allocation to bonds since August 2009. Nonetheless, fixed-income allocations were above their historical average of 16% for the 48th consecutive month.

Cash allocations rose 4.0 percentage points to 20.7%, the largest since March. June was the 19th consecutive month with a cash allocation below its historical average of 24%.

Last month’s rise in yields and return of volatility to the stock market left individual investors feeling slightly more conservative with how they manage their portfolios. Though equity allocations declined and cash allocations rose, both remain well within the ranges recorded by our survey over the past several months.”

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.