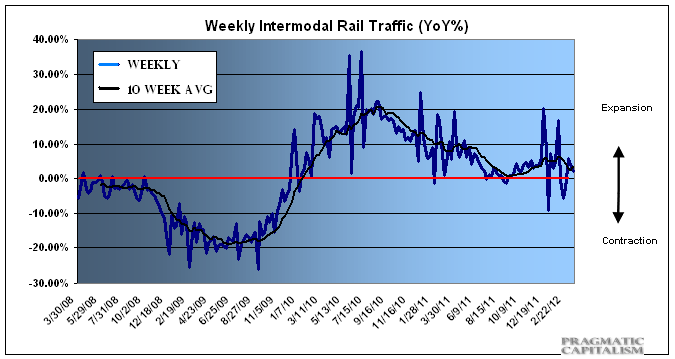

The story from rail traffic is becoming increasingly mixed, but the trend in growth is clearly on the decline although much of the discrepancy is coming from the coal segment. Growth continues to be better in other segments, but the overall picture is still relatively sluggish. The 10 week moving average in intermodal traffic sits at 3.3% which is consistent with a growing, but sluggish economy. The AAR has the details:

“The Association of American Railroads (AAR) today reported U.S. rail carloads originated in March 2012 totaled 1,123,298, down 69,190 carloads or 5.8 percent, compared with March 2011. Intermodal volume in March 2012 was 928,350 containers and trailers, up 31,348 units or 3.5 percent compared with March 2011. Detailed monthly data charts and tables will be available in the AAR’s Rail Time Indicators report released online tomorrow.

Twelve of the 20 commodity groups tracked by AAR showed gains in March 2012 compared with the same month last year, including petroleum and petroleum products, up 9,052 carloads or 34.2 percent;

motor vehicles and parts, up 9,032 carloads or 15.3 percent; steel and other primary metal products, up 3,459 carloads or 8.3 percent; crushed stone, gravel, and sand, up 3,211 carloads or 4.8 percent; and metallic ores, up 1,642 carloads or 8.1 percent.

Commodities with carload declines in March were led by coal, down 84,854 carloads or 15.8 percent from March 2011. Other commodities with declines included grain, down 9,088 carloads or 9.7 percent; chemicals, down 4,278 carloads or 3.4 percent; nonmetallic minerals, down 1,863 carloads or 9.7 percent; and farm products excluding grain, down 479 carloads or 13.3 percent. Carloads excluding coal and grain were up 4.4 percent or 24,752 carloads in March 2012 over March 2011.

“There is no denying that coal is a crucial commodity for railroads, and there’s also no denying that recent declines in coal traffic are presenting significant challenges to railroads right now,” said AAR Senior Vice President John T. Gray. “That said, it’s encouraging that many commodities that are better indicators of the state of the economy than coal is — things like motor vehicles, lumber and wood products, and crushed stone — saw higher rail carloadings in March.”

Class I employment fell to 159,228 in February 2012, a decline of 105 employees from January 2012. Total Class I employment was 4,726 employees, or 3.1 percent, greater in February 2012 than in February 2011. In February 2012, most major classes of rail employees saw declines from the month before. The one exception was train and engine employees, whose employment rose by 170 in February 2012 over January 2012.

As of April 1, 2012, 299,324 freight cars were in storage, an increase of 9,819 from March 1, 2012, and equal to 19.6 percent of the North American fleet.

AAR today also reported mixed weekly rail traffic for the week ending March 31, 2012, with U.S. railroads originating 286,962 carloads, down 6.2 percent compared with the same week last year. Intermodal volume for the week totaled 242,772 trailers and containers, up 3.6 percent compared with the same week last year.

Twelve of the 20 carload commodity groups posted increases compared with the same week in 2011, with petroleum products, up 38.2 percent; motor vehicles and equipment, up 17.2 percent, and metals and products, up 16.9 percent. The groups showing a significant decrease in weekly traffic included farm products excluding grain, down 19.7 percent; nonmetallic minerals, down 18.9 percent, and coal, down 18.2 percent.

Weekly carload volume on Eastern railroads was down 3.2 percent compared with the same week last year. In the West, weekly carload volume was down 8.2 percent compared with the same week in 2011.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.