Abenomics appears to be working fairly well so far, but can it be sustained? Can the “third arrow” be implemented in such a manner that it overcomes what I view as an enormous economic hurdle – the declining population? I think we’ll have to wait a while to judge the efficacy of the program, but for now it does appear to be working better than I would have expected.

Here are some of the details. Q2 GDP was just revised up to 0.9% quarter on quarter. That’s the highest rate of growth in over a year:

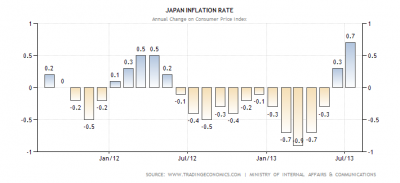

Inflation also jumped to 0.7%. This was the highest reading since 2008 though it does appear to be largely driven by energy prices:

Of importance, Japan is running a large budget deficit and government spending has been highly expansionary. So I think it would be wrong to characterize Abenomics as a purely monetary policy approach:

So where’s the boost in growth coming from in recent quarters? Well, I think the most obvious component has been the exchange rate change. The Japanese government claims to not be intervening, but I have my doubts about that as the transmission mechanism doesn’t appear to come from anywhere else. We also have the highly expansionary fiscal policy. And then there’s the old “Chuck Norris” effect of tough monetary talk. Will it all sustain itself? I have serious doubts, but I am definitely open minded to the idea that targeting monetary policy WITH fiscal policy is an effective approach and Japan might just be proof that that’s the way to move forward in the future.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.