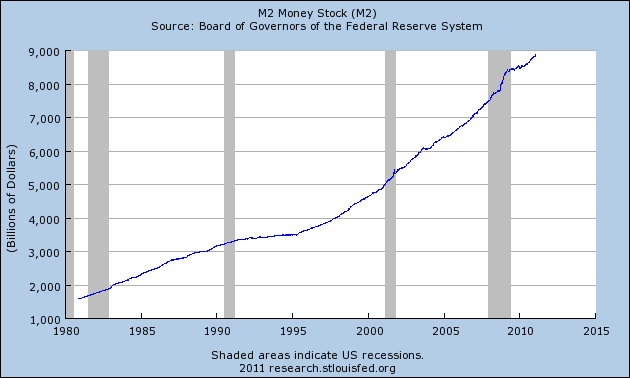

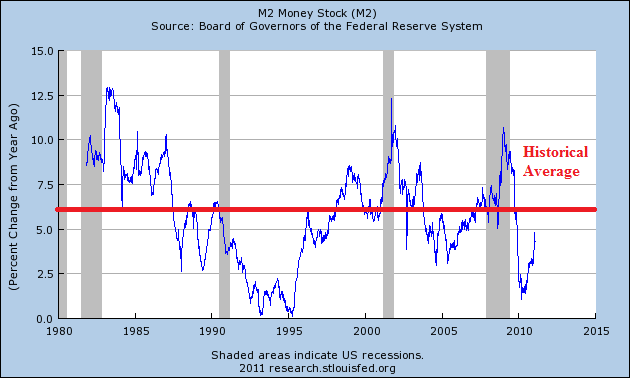

There has been a great deal of chatter in recent weeks about how the US money supply is suddenly exploding to the upside. This case has been primarily built on the back of the recent uptick in M2. We’ve previously noted that the broader money supply (m3 according to various independent sources) is still contracting on a year over year basis.

In addition, we have shown that the expansion in the money supply is nothing compared to what China has been doing. But even when taken alone, the M2 data is nothing all that extraordinary. In fact, it is still expanding at well below its historical levels. While we’re seeing some tepid signs of inflation (almost entirely due to non-core) the broader data still shows a very weak case for high levels of inflation in the USA this year.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.