Complacency must be setting in again because you all are getting lazy. While the rise of low fee funds and advisors continues en masse, the average advisor is actually RAISING their fee. That’s right. According to Investment News the average advisory fee rose by 3 bps to 1.02% in 2014.

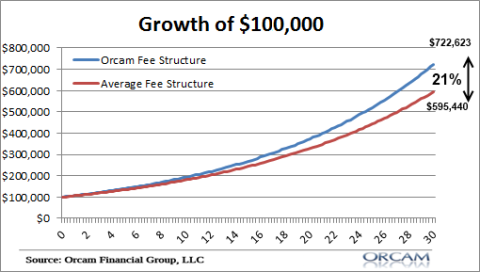

I’ve discussed this in great detail before, but lowering your fees are one of the few ways to guarantee a higher return. For instance, my asset management service is just 0.35%. if you invested $100,000 in two portfolios that earned 7% per year, the industry average of a 1% fee will result in a balance that is $127,000 less than Orcam’s 0.35% fee structure over a 30 year period. In other words, paying a high fee for asset management reduces your total balance by over 20%.

If you’re willing to go the DIY route you can get that fee down even lower. But please, please don’t let your advisor raise your fees just because the market appears to be in a perpetual bull market. This is a classic sign of complacency. You don’t have to pay an arm and a leg for smart asset management. Don’t let anyone try to convince you otherwise.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.