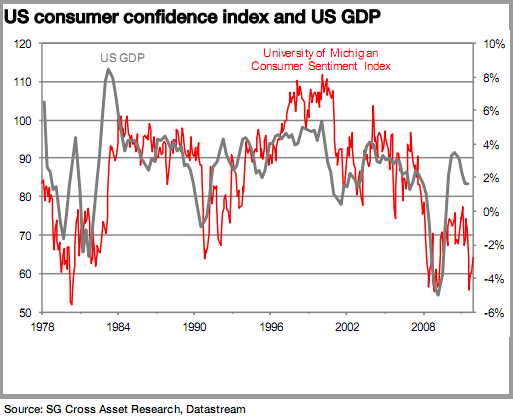

There’s certainly no bull market in sentiment. And rightfully so. A total lack of leadership and what is now clearly a continual economic malaise has consumers feeling downright awful about the global economy. But is it possible that depression in sentiment could lead to renewed recession? As Societe Generale notes in a research piece this morning, there is an alarmingly high correlation between sentiment and GDP. As of this month, current sentiment readings imply that the US economy could be in recession by Q1 2012:

“Even if financial markets keep monitoring the situation in Europe closely, the focus should now zoom in on the US economy. The latest University of Michigan Consumer Sentiment Index came in at 64.2, its highest level since June, and the third consecutive monthly improvement. But, we can clearly see in this chart that consumer confidence is still very close to historical lows, with US growth remaining clearly at risk. The debt super committee is expected to submit a deficit reduction program to Congress before 23 Nov. Talks are still tense between republicans and democrats, and no decision has yet been made on the balance between spending cuts and tax hikes to come to cut the deficit over a 10-year period.”

Source: SG Research

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.