Back in early 2009 the public was euphoric about President Obama and the change he was ushering in. At the time I asked if expectations were too high:

On the bright side, [Obama’s] entering office when things are downright awful, which likely means we’re closer to the bottom than the top. But you still have to wonder, with such an enormous global economic mess, are expectations too high for President Obama? Let’s just say, if I could short approval numbers, I’d be calling an Obama top….

Obama’s approval rating peaked around then and the economy troughed a few months later. Markets and economies tend to move in something that resembles a cyclical pattern. Our behavior and response to these cycles tend to be lagging. Hence, it is often when the economy looks its absolute strongest that it is at its absolute most fragile stage. Or as Hyman Minsky once said, stability creates instability.

Think of the economy like a balloon that you slowly fill with helium. As you fill that balloon you reach a natural level of peak expansion before you can’t fill the balloon any further. If you fill it too much the bubble bursts. If you let it recover naturally the helium slowly seeps out of it before you need to refill it (think, recession). The economy is like a balloon whose potential size grows indefinitely across long periods of time, but at times grows faster than it should (resulting in a bubbly bust) or enters a recession before needing a new injection of helium. But the main point is, when the helium is low it means there is great upside potential. And when the balloon is filled it means there is less potential for growth.

When Obama was coming into office the public was so euphoric about change that the approval numbers were unsustainably high. At the same time, the cyclical trend in the economy was so bad that there was a high probability of some mean reversion and recovery. The public’s overall sentiment was better captured in President Bush’s low approval rating of 35% at the end of his second term and the consumer confidence figures which bottomed in 2009. In other words, President Obama was becoming President at an extremely fortunate time. And although he probably underperformed his stratospheric expectations he did better than most probably expected.

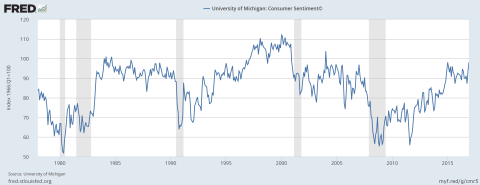

And here’s the interesting part about Trump’s Presidency – how much room is left in this balloon? For instance, how much higher can consumer confidence go?

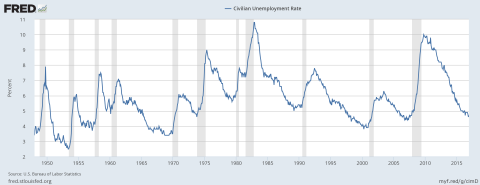

Or, how much more employment can you pull out of an economy plumbing very low levels of unemployment?

This looks like a balloon that is much closer to its max capacity than vice versa. And while I certainly think there’s room to grow you have to wonder if we aren’t seeing the exact opposite reaction to Trump that we saw to Obama. In other words, are Trump’s approval figures too low and are his expectations for economic growth unrealistically high? I don’t know the answer and I certainly don’t know the timing of the end of economic cycles, but this balloon looks a lot closer to full expansion than the economy that Barack Obama inherited. And so the smart betting man to has think that the potential for greater instability is higher today than the economy that was so unstable at the start of Barack Obama’s term.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.