There is a good deal of worry in recent weeks over the sharp increase in junk bond yields and what they might portend for the future of the economy. I wanted to explore this a bit more closely to see if we can’t decipher what might be going on here.

First, it’s important to put the “junk” bond market in perspective:

- Junk bonds are a relatively young asset class as they were first sold en masse in the mid-80s.

- The junk bond category is not necessarily a static rating. What often looks like investment grade turns out to be “junkier” than the ratings agencies expected (see most of the high rated bonds from the financial crisis, eg).

- Because of the brief history of the junk bond segment we only have three real business cycles and contractions to analyze. This is certainly not a satisfactory data set to analyze. This renders the junk bond segment less useful than many imply.

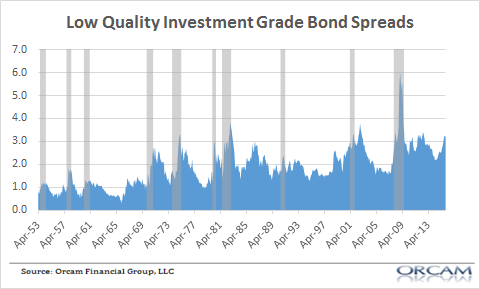

Because of the above facts I find it more helpful to look at “near” junk bonds or low grade investment grade bonds since these bonds have a much longer track record to study and they often turn out to be junk bonds in a recession anyhow. Further, the spread between Baa Corporates and T-Bonds relative to Junk Bonds has over a 93% correlation during the lifetime of Junk so these low quality investment grade bonds act as a good synthetic version of junk for studying a more relevant data set. Lastly, the low quality investment grade segment has acted as a smoother indicator over its lifetime and didn’t give false readings such as the sharp spread increase that we experienced in 2011 which led many market commentators to argue that this was foreshadowing something highly negative.

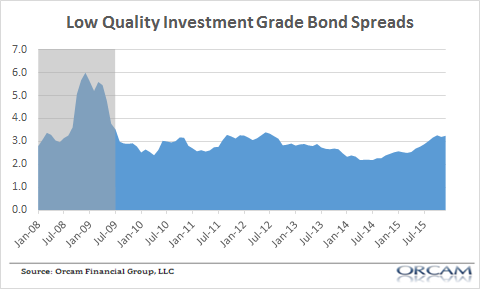

As you can see in the chart above, spreads do tend to widen before or during a recession. To factor in for anchoring bias it’s useful to notice that a rough doubling in the spread leads or coincides with recession in 8 of 10 instances. This means that a sharp widening in spreads can portend recession. However, we have to be careful interpreting the current state of the credit markets. The recent rise in spreads has not been consistent with a sharp deterioration in broader credit markets. In fact, the spreads in the low quality investment grade segment never got that low in recent years as we can see when we look more closely at the post crisis period. The recent 106 bps spread increase has merely taken us back to levels largely consistent with much of the post-crisis period:

Given this analysis, the recent widening in spreads looks to be contained specifically in the very lowest quality corporate bonds. We are not seeing widespread contagion that has filtered into segments of the bond market where spread increases become consistent with recession. A broader spreading into higher quality credits would be a much more worrisome situation since, as I’ve noted in the past, the junk bond segment is a relatively small slice of aggregate credit markets.¹ If we start to see widespread contagion into higher quality credits we’ll very likely be in a recession or on the verge of one, however, given the weakness of the current recovery we have to ask ourselves – how far can we fall when we’ve only gotten to one knee?

Sources:

¹ – Three Lessons From the Junk Bond Collapse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.