Our friends over at Sober Look asked an interesting question over the weekend – why did T-bonds rally if the job’s report was stronger than expected? This is not an easy question to answer, but I think he touches on one of the potential causes – wages and inflation.

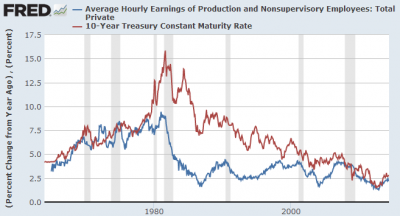

While the headline figure in the payroll report was quite strong, the underlying data showed very little signs of inflation on the horizon. This seems strange, but its been a consistent characteristic in the US labor market for much of the last 10 years. Average hourly earnings just aren’t rising very rapidly even when payrolls are strong. This past month’s report showed steady earnings at 34.5 hours and average earnings were flat versus expectations of a 0.2% monthly increase.

There’s just no sign of high inflation on the horizon so bond traders remain relatively calm about the potential for future price erosion in the holdings. The story’s probably a bit more complex than that, but in the long-run, inflation is a bond trader’s worst enemy so it’s probably not too much more complex than that….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.