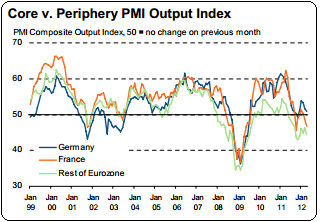

Now this is starting to get really interesting. Today’s flash PMI in Europe was a disaster. Not only are the periphery countries predictably weak, but we’re seeing the weakness seep into the core. The following from the Markit report summarizes the situation:

“The Markit Eurozone PMI Composite Output Index fell to a five-month low in April, according to the preliminary ‘flash’ reading which is based on around 85% of usual monthly replies. The index fell

for the third month in a row to 47.4, down from 49.1 in March, to signal a faster rate of decline of private sector economic activity. Output has fallen seven times in the past eight months.Output fell at the fastest rates for five months in both manufacturing and services, with the former

seeing the steeper rate of decline.By country, growth slowed to only a very modest pace in Germany, showing the weakest expansion

in the current five-month sequence as weak service sector growth was offset by a sharp decline in manufacturing output. France meanwhile saw output fall for the second month in a row, with the

rate of decline accelerating to the fastest since October. Falling manufacturing output was

accompanied by a steep deterioration in service sector activity.The big-two euro countries nevertheless continued to outperform the rest of the region where output

fell sharply, down for the eleventh successive month and at the fastest pace for four months. Steep declines in both manufacturing output and services activity were seen in the periphery.”

So we seem to have a bit of a positive feedback loop here. The core’s customer base (mainly the periphery) is weakening under austerity and slowly sucking the life out of the core. Now the Euro crisis will start to kick into a more interesting phase because the phase it’s absolutely not going to kick into is the phase where they all grow out of this….The math just doesn’t work for the periphery countries. And that means a lot more dead weight in the coming years and more of the same bailouts to come….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.