(Cross posted from Modern Monetary Realism)

The recent crisis has been beneficial in at least one way – it has begun to shed light on some of the myths of our monetary system that have poisoned economics and politics for many decades. If I had to rank some of these myths I would almost certainly put the currency user vs. currency issuer myth at the top of the list. But a close second is the myth of the money multiplier. Students are generally taught that our banking system works through some sort of “loanable funds” market or “money multiplier” whereby banks obtain deposits so they can then loan them out. There’s just one problem with these ideas – they’re not right.

These ideas have all come to a head in recent weeks when Paul Krugman and Steve Keen got into a bit of a back and forth about the operational realities of the banking system. I won’t comment specifically on the ideas of either men, both of whom are fantastic economists, but I think this conversation exposes the degree to which most people continue to misinterpret modern banking and requires some brief discussion.

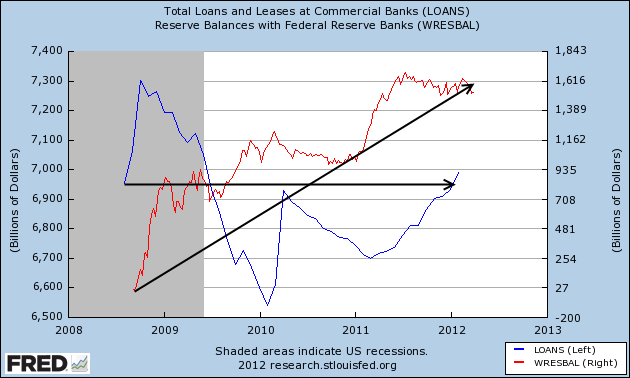

The standard banking model says that banks are reserve constrained and that the amount of loans a given bank can make is a multiple of its reserves. But the recent crisis has shot king sized holes in this myth. The Fed has substantially expanded the amount of reserves in the banking system, but lending has flat-lined:

(Figure 1 – Total Reserve Balances vs. Total Loans)

This is a monumentally important chart so it’s important to understand a few points if you’re going to understand why the above chart looks the way it does:

- Reserve balances are determined by the Federal Reserve who acts as the supplier of reserves to the banking system. Banks can never “get rid” of reserves in the aggregate. They can shuffle them among each other, but only the Fed can destroy or create reserves through open market operations. The Fed oversees the payments system and in doing so must act to ensure that banks can obtain reserves in order to settle payments and meet reserve requirements as needed.

- Bank lending is not reserve constrained (in fact, many countries don’t even have reserve requirements at all). This means that banks do not need reserves before they make loans. Instead, banks make loans first and obtain reserves in the overnight market (from other banks) or from the Fed after the fact (if needed). New loans result in a newly created deposit in the banking system.

- Banks are capital constrained. Banks can always find reserves from the central bank so banks do not check reserve balances before making loans. Instead, they will check the creditworthiness of the borrower and their own capital position to ensure that the loan is consistent with the goal of their business – earning a profit on the spread between their assets and liabilities.

- Banks attract deposits because they want to maintain the cheapest liabilities possible in order to maximize this spread on assets and liabilities. Banks are, after all, in the business of making a profit!

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.