I wrote about this briefly a few weeks ago, but given that one of the main components of Ben Bernanke’s QE success revolves around the “wealth effect” of rising asset prices, one has to wonder if Dr. Bernanke hasn’t fallen victim to a classic investing axiom.

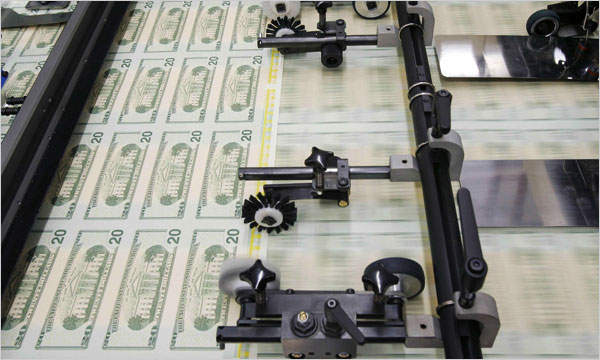

When Bernanke implemented QE1 the markets were in a death spiral. The government’s actions played a huge role in stabilizing prices. Sort of like the recent ECB intervention in European periphery bond markets. The government comes in and makes a market with their printing press and confidence returns as investors realize that you don’t bid against the guy with a printing press. So, QE1 “worked” in that it had a hugely stabilizing effect. QE2 was a bit different, but one could argue that it also had some stabilizing effect since markets had fallen substantially prior to the policy’s implementation. The subsequent market rallies gave the appearance that the Fed had saved the day.

So, I think we’re at a very interesting point in the history of monetary policy. Instead of implementing QE low (following the old buy low, sell high mantra) Bernanke implemented QE after a huge “wealth effect” had already occurred. He wasn’t buying into a market decline like QE1 and QE2. He was essentially buying after the rumor had leaked. So the interesting thing here is, will the market “sell the fact”? And will we look back at QE3 and say it was a failure or a success because of Dr. Bernanke’s failure to adhere to the most basic investment principle in the world – buy low, sell high? I don’t know. I have tended to think QE is far weaker than most presume, but given that it’s one strong point has tended to revolve around its influence on stock prices, this version of QE could play out more interestingly than the last few events….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.