It’s hard to be optimistic about the economy given the Fed Chief’s comments today. He said:

“Under these assumptions [by the CBO], the budget deficit would be more than 4 percent of GDP in fiscal year 2017, assuming that the economy is then close to full employment. Of even greater concern is that longer-run projections, based on plausible assumptions about the evolution of the economy and budget under current policies, show the structural budget gap increasing significantly further over time and the ratio of outstanding federal debt to GDP rising rapidly. This dynamic is clearly unsustainable.” (emphasis mine).

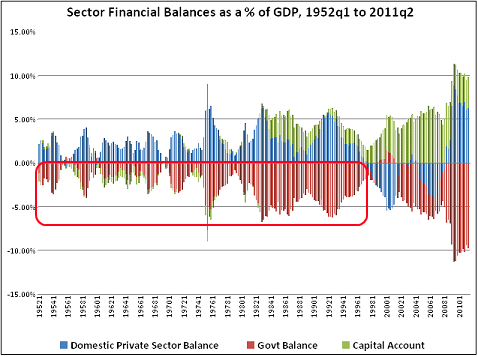

But let’s look at the facts. Since 1952 the government’s budget deficit has averaged 2.6%. Not quite the 4% level that Bernanke cites, but certainly “in the red” according to the way that we are all taught (wrongly) to think about a government budget deficit being analogous to a household’s budget. Not surprisingly, Paul Ryan was fueling much of the heat on the deficit today. The odd thing is that under the Republican’s hero Ronald Reagan (from 1980-1988), the budget deficit averaged 4.8%. You can clearly see the sea of red in the government’s deficit since just about the beginning of the chart:

The government always runs a budget deficit!

So if it’s “unsustainable” then we could have had the exact same conversation in 1982 when the budget deficit was 6.3% (right before an epic economic boom). The confusion of course is surrounding why this is unsustainable and that’s where Dr. Bernanke’s comments were most alarming. He said:

“…Even the prospect of unsustainable deficits has costs, including an increased possibility of a sudden fiscal crisis. As we have seen in a number of countries recently, interest rates can soar quickly if investors lose confidence in the ability of a government to manage its fiscal policy. “

Dr. Bernanke doesn’t explicitly mention Greece and Europe, but he certainly alludes to Europe. And of course, he’s entirely misinterpreting the difference between being an autonomous currency issuer and being a currency user (like European nations). An autonomous currency issuer doesn’t “run out” of money. Their true constraint is inflation (and we always inflate, but notice that living standards haven’t collapsed since 1950!).

Thankfully, someone close to Dr. Bernanke knows the difference. Paul Krugman has recently been highlighting the importance of being a currency issuer. Let’s hope he invites Dr. Bernanke back up to Princeton to clue him in on this important fact….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.