I’ve spent way too much of my career cautioning investors about extremist positions. No, there wasn’t a bond bubble in 2010. No, the stock market wasn’t a bubble back in 2013. No, the USA wasn’t going bankrupt in 2012. No, QE wasn’t going to cause hyperinflation. You get the point. I try to be objective and pragmatic and a big part of that involves empirically sound and operationally consistent analysis so we can make relatively high probabilistic conclusions about the world. Extremist views about the markets tend to be more emotionally and politically motivated which makes them far less empirically sound and lower probability outcomes.

One view that has dominated much of the extremist landscape is the idea that the 30 year bond bull market is about to end and yields will skyrocket up and destroy your bond portfolio. You know, the 1970s are right around the corner. I’ve read some version of this theory for as long as I can remember. But this one really takes the cake for me:

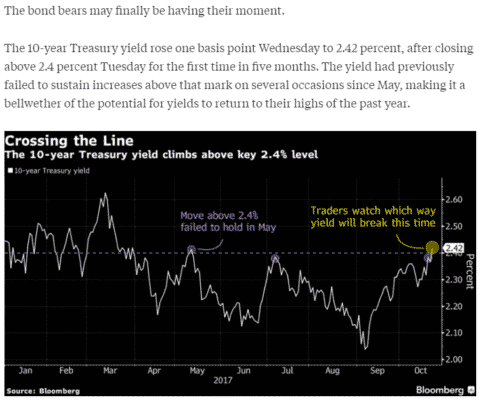

Let’s break this down a bit. The article is taking a 10 year instrument and citing a 12 month period during which it zigzagged around a random line. I have no idea why 2.4% would be significant, but the article says that this is the “moment of truth” for the bond bull market. So the prediction is basically this:

“After 30+ years of disinflationary trends in the economy bond yields will suddenly shoot higher because some traders notice that yields crossed over a line someone drew on a chart that connects two random points in the past.”

Alright, alright. I am being snarky. I am sorry. But let’s seriously think this through. Yields are low because inflation is low. Inflation is low because there are significant 30 year disinflationary trends putting downward pressure on prices. As I explained back in 2014, this is not the 1970s. The macro trends are very different today than they were then. Yields are not going to shoot higher just because some lines on a chart were breached. That is not how the bond markets work. So, if you’re going to make an argument for higher yields then you’re implicitly making an argument that inflation is going to be higher. And if you’re going to make that prediction then it should be supported by more than this idea that yields (and thus actual economic inflation) will move higher because someone noticed a trendline breaking on a picture. You have to support that argument with some sound empirical evidence that is consistent with higher inflation and thus higher yields in the future. After all, the expectation and realization of higher rates of inflation is what will drive long bond yields to price in higher interest rates.

I have no problem making fairly short-term predictions about the bond market. Yeah, you don’t want to be too short-term about these things (like, obsessing over daily, monthly or even annual changes), but the bond market is, after all, a fairly short-term instrument with an aggregate average maturity of 8 years and an effective duration of 5.7 years. And I have repeatedly said that I think some degree of more active management is prudent in a bond portfolio where low rates create the potential for unusually high interest rate risk. But beware of extremist calls that will entice you to take “all in” or “all out” positions in the markets. These sorts of calls are usually just pundits playing on your emotions and trying to grab headlines as opposed to making sound and evidence based probabilistic conclusions.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.