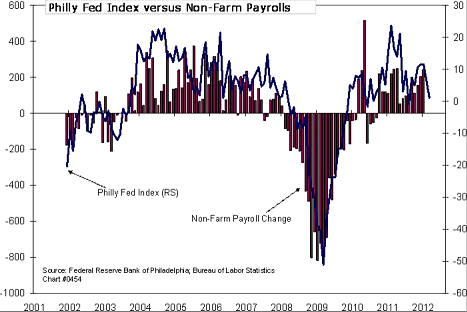

The monthly non-farm payrolls figures are notoriously hard to predict, but Jack Ablin of Harris Private Bank highlights one of the reasons why he’s been such a prescient forecaster of the figure – he uses the Philly Fed’s Employment Index. And the index recently tanked from 11.6 to 1.1. According to Politico this would give us a NFP figure of 50,000, a massive downside disappointment:

“COULD FEBRUARY JOBS NUMBER TANK? – M.M. spoke with Harris Private Bank’s Jack Ablin who has been among the most accurate predictors of the monthly non-farm payrolls report, largely by following the Philly Fed’s employment index. The index, based on a survey of employers’ hiring plans, has been tightly correlated with the NFP numbers. And on Thursday the Philly employment index tanked from 11.6 to 1.1 … This suggests a February jobs gain of just 50,000, a huge drop from January’s 243,000.

The Philly number COULD be an outlier. But if it isn’t, it’s a worrisome sign that employers have largely done the hiring they feel they need to do and are now waiting to see if demand picks up before adding any more workers. But without more workers getting jobs, it’s hard for demand to pick up. … Ablin: “I’m not sure where economists’ estimates are yet for February jobs. But they were 100K short last month and now they may wind up overestimating the number. … What [the Philly Fed] is doing is asking respondents if they are going to add or get rid of jobs.

“It looks like they are saying they are still adding, but very few. … And if you look at corporate income statements, they have cut pretty much everything they can cut, cost-wise. And they have a lot of operating leverage. … But if revenues don’t come through, they will just sit there. I won’t worry about one 50,000 jobs month too much … But I do hope the Philly Fed is wrong this time.”

Read more here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.